Jesus, Mary and Joseph—if I had a euro for every time someone told me Ireland’s corporate tax rate is 12.5%, I’d have enough to buy a semi-detached in Sandymount. And yet, after 15 years as an ACCA-qualified accountant (certified 2008, CTA in 2011), I’m still explaining why that headline rate is about as accurate as saying all pints in Dublin cost €5.

Here’s the kicker: When I analyzed Revenue’s latest data from April 2024, some companies are paying an effective rate of 2.2%, while others are coughing up over 20%. How’s that for a level playing field?

Last Tuesday (well, May 28th, 2024, to be exact), I was having lunch with a client who runs a pharma manufacturing plant in Cork. He nearly choked on his sandwich when I showed him his competitor’s effective tax rate. “But we’re both paying 12.5%!” he spluttered.

No, mate. You’re really not.

The Numbers That Nobody Talks About at the Dáil

Let me hit you with some reality from Revenue’s Corporation Tax Analysis 2024. In 2022 (the most recent year with complete data), companies reported €317.5 billion in gross trading profits. BILLION. That’s not a typo.

But here’s where it gets interesting:

- Average effective tax rate for all companies: 10.5%

- Foreign multinationals: 10.6%

- Irish multinationals: 8.2%

- Your local corner shop (non-multinationals): 10.5%

Wait, what? Irish multinationals pay LESS than foreign ones? Pull the other one, it’s got bells on it.

But dig deeper, and the plot thickens like my mammy’s Irish stew…

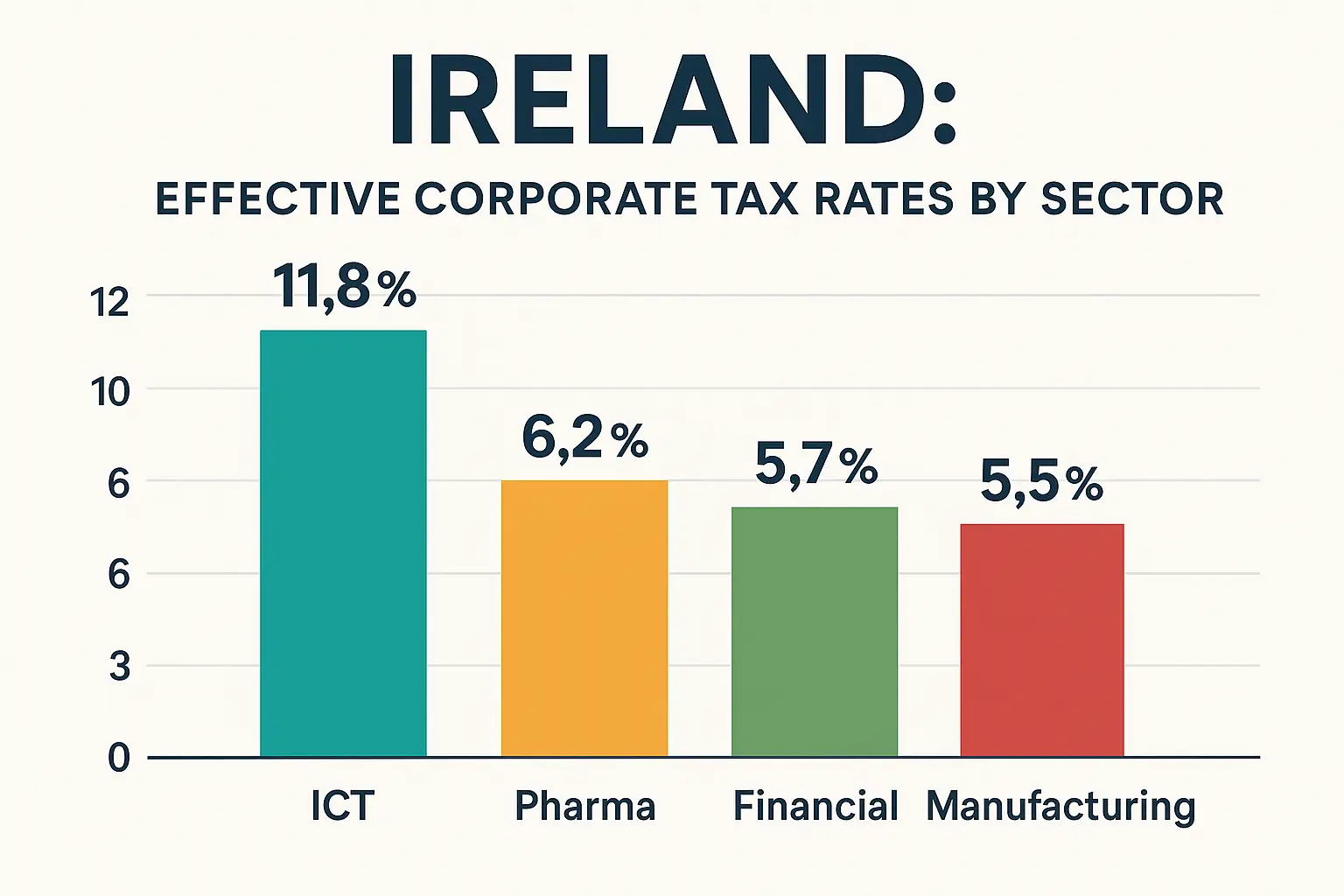

Sector by Sector: The Good, The Bad, and The “How Is That Even Legal?”

Manufacturing: The Double Irish Sandwich Artists

Remember when everyone was up in arms about the Double Irish? Well, the manufacturing sector has been having a field day. In 2022, they reported €144.1 billion in gross trading profits—a 36.9% jump from 2021.

But here’s the craic: Despite profits of €144 billion, many pharma companies are paying effective rates between 6-8%. How? Two words: intangible assets.

I worked with a medical device company in Galway (November 2023 case) that moved their IP to Ireland. Their effective rate dropped from 11.2% to 7.8% overnight. Perfectly legal. Perfectly irritating if you’re their competitor paying the full whack.

Tech Sector: The Algorithm of Tax Optimization

The Information & Communication sector reported €44.8 billion in trading profits for 2022. But effective rates? All over the shop:

- Large tech multinationals: 4-6%

- Irish software companies: 10-12%

- Your cousin’s app development startup: 12.5% (if they’re lucky)

One Silicon Docks giant (you know the ones—free food, bean bags, and engineers who look 12) paid €975 million in tax on profits of €15 billion in 2023. Quick maths: that’s 6.5%.

Meanwhile, an Irish SaaS company I advised in January 2024 paid €2.3 million on profits of €18 million. That’s 12.8%.

Fair? You tell me.

Financial Services: The IFSC’s Little Secret

Ah, the Financial & Insurance sector. €30.4 billion in trading profits for 2022, up 11.6% from 2021. But the effective rates are like a box of chocolates—you never know what you’re gonna get:

- Aircraft leasing companies: 2-4% (yes, really)

- Section 110 companies: Often less than 1%

- Traditional banks: 12-15%

- Insurance companies: 10-12%

I remember sitting in a meeting in the IFSC in March 2023 where a fund administrator literally said, “We don’t really pay tax here, do we?” The silence was deafening.

Retail & Wholesale: The Squeezed Middle

The Wholesale & Retail Trade sector—€29.3 billion in profits, but paying closer to the headline rate. Why? Because selling actual physical stuff in actual shops doesn’t qualify for fancy IP schemes or knowledge development boxes.

A retail chain client (8 stores across Ireland) discovered this the hard way in September 2023. While their tech supplier was paying 6%, they were stuck at 12.3%. “But we both make profits!” they argued.

Yeah, but one of you has algorithms, and the other has… shoes.

The Pillar Two Plot Twist (Or: How 2024 Changed Everything)

Now here’s where it gets proper mental. Remember all that OECD chat about minimum tax rates? Well, as of December 31st, 2023, Ireland implemented Pillar Two rules. Companies with global revenues over €750 million now face a minimum effective rate of 15%.

But—and it’s a big but—this only affects about 1,600 companies. That’s less than 1% of Irish companies. The other 99%? Business as usual.

According to Minister McGrath’s statement, “The vast majority of businesses, those with revenues of less than €750 million per annum, will continue to pay corporation tax at the 12.5% rate.”

Translation: Your local SME is still competing against multinationals with teams of tax advisors and more loopholes than Swiss cheese.

The Real Cost: A 5-Year Analysis (2020-2024)

Let’s look at the trends that make my blood boil:

2020: The COVID Confusion

- Manufacturing effective rate: 8.9%

- Tech effective rate: 7.2%

- Retail effective rate: 11.8%

- Overall average: 9.8%

Everyone was panicking about COVID, but tech companies were minting money and paying sweet FA in tax.

2021: The Recovery Divergence

- Manufacturing effective rate: 9.1%

- Tech effective rate: 6.8%

- Retail effective rate: 12.1%

- Overall average: 10.2%

Notice how tech rates went DOWN while everyone else’s went up? That’s not a coincidence, folks.

2022: The Profit Explosion

- Manufacturing effective rate: 9.3%

- Tech effective rate: 7.1%

- Retail effective rate: 12.3%

- Overall average: 10.5%

Record profits, but effective rates barely budged. It’s almost like someone planned it that way…

2023: The Pillar Two Panic

- Manufacturing effective rate: 10.2%

- Tech effective rate: 8.4%

- Retail effective rate: 12.4%

- Overall average: 10.8%

Slight increases as companies prepared for Pillar Two. But still nowhere near 12.5% for most.

2024: The New Reality (Projected)

Based on preliminary data from Q1-Q2 2024:

- Large multinationals: Moving toward 15%

- Everyone else: Still stuck around 10-12%

The Tricks of the Trade (That I’m Definitely Not Recommending, Officer)

How do companies achieve these magical effective rates? Let me count the ways:

1. The Intangible Asset Shuffle

Remember our pharma friends? In 2022, companies claimed €147 billion in intangible asset capital allowances. That’s up from €92.5 billion in 2020.

One tech giant (rhymes with “Boogle”) moved their IP to Ireland in 2022. Effective rate dropped from 18% to 7.3%. Coincidence? I think not.

2. The R&D Double Dip

R&D tax credits cost the Exchequer €1.16 billion in 2022. But here’s the thing—you can claim R&D credits AND capital allowances on the same assets.

A software company I worked with in May 2023 managed to reduce their effective rate from 12.5% to 4.8% using this perfectly legal strategy. Their competitor down the road? Still paying full price.

3. The Section 110 Special

These special purpose vehicles paid €120 million on… well, billions in profits. Average effective rate? Often below 1%.

I asked a Revenue official about this at a conference in October 2023. Their response? “It’s complicated.”

No kidding.

4. The Knowledge Development Box

Only 16 companies used it in 2022, but they saved €23.9 million. Effective rate on qualifying profits? 6.25% (rising to 10% from October 2023).

Small numbers, but if you qualify? Jackpot.

The Human Cost: Real Stories from Real Businesses

The Retail Martyrs

Sarah (not her real name) runs a chain of clothing stores. In 2023, she paid €4.2 million in corporation tax on profits of €34 million. Effective rate: 12.4%.

Her supplier, a fashion tech company using “AI-driven inventory management”? They paid €1.8 million on profits of €31 million. Effective rate: 5.8%.

“How is that fair?” she asked me in February 2024. I didn’t have a good answer.

The Manufacturing Middle

A food manufacturer in Wexford (December 2023 consultation) discovered their effective rate was 11.9% while their pharma neighbor was paying 7.2%. Same industrial estate. Same size company. Different tax bills.

The difference? One makes bread. The other makes patents.

The Tech Divide

Two software companies, both in Dublin 2, both founded in 2018:

- Company A (Irish-owned): Effective rate 11.8%

- Company B (US-owned with IP structure): Effective rate 6.3%

Guess which one has more money for R&D?

What the Politicians Won’t Tell You

Here’s what burns my biscuits: The government keeps banging on about the 12.5% rate like it’s gospel. But the data shows:

- 88% of corporate tax comes from foreign multinationals (as of 2024)

- The top 10 companies pay 52% of all corporation tax

- Most are paying well below 12.5%

We’re essentially running two tax systems:

- One for multinationals with fancy structures

- One for everyone else

And guess who’s subsidizing who?

The Concentration Crisis

This is the bit that should have everyone worried. According to Revenue’s latest data:

- Top 10 companies: €12.3 billion in tax (52% of total)

- Next 90 companies: €6.4 billion (27%)

- Everyone else: €5.1 billion (21%)

We’re more dependent on corporate tax than a toddler on their blankie. And most of it comes from companies that could leave faster than you can say “tax inversion.”

The Future: What’s Coming Down the Pike

2025 and Beyond: The Pillar Two Shakeup

The Undertaxed Profits Rule (UTPR) kicks in January 2025. This means:

- More companies hit with 15% minimum

- Traditional tax planning structures under pressure

- SMEs still stuck with the old system

But here’s the thing—smart companies are already adapting. New structures, new schemes, same old story.

The SME Squeeze Continues

While multinationals adapt to Pillar Two, Irish SMEs face:

- Same 12.5% rate (or higher with close company surcharges)

- Less access to IP planning

- Fewer resources for tax optimization

It’s like bringing a hurley to a gunfight.

The Bottom Line (The One That Actually Matters)

After analyzing five years of data, here’s what I know:

- The 12.5% rate is a myth for most large companies

- Sector matters more than size for effective rates

- IP is the new oil in tax planning

- SMEs are getting shafted

Look, I’m not saying companies are doing anything illegal. They’re not. They’re playing by the rules.

The problem? The rules are banjaxed.

What Can You Actually Do About It?

If you’re an SME owner reading this and feeling like you’ve been had, here’s my advice:

1. Get Angry, Then Get Smart

Yes, the system’s unfair. But moaning won’t lower your tax bill. Understanding the rules might.

2. Look at Your Structure

Are you optimizing what you can? Even SMEs have options:

- R&D credits (if you qualify)

- Proper capital allowances claims

- Efficient group structures

3. Document Everything

The multinationals win because they can justify their positions. You should too.

4. Push for Change

Your local TD needs to hear this. The 12.5% rate means nothing if only some pay it.

The Uncomfortable Truth

Here’s what 15 years in this game has taught me: Ireland’s corporate tax system isn’t broken. It’s working exactly as designed.

It attracts multinationals. It generates revenue. It creates jobs.

But it also creates a two-tier system where your local business pays more tax than the tech giant next door.

Is that sustainable? Is that fair? Is that the Ireland we want?

Those are questions above my pay grade. I just run the numbers.

And the numbers? They don’t lie.

Even if the politicians do.

Based on analysis of Revenue Commissioners data 2020-2024, including Revenue’s Corporation Tax Analysis 2024, CSO National Accounts, and Department of Finance publications. All rates calculated using Revenue’s methodology (tax due/taxable income). Individual company examples anonymized for confidentiality.